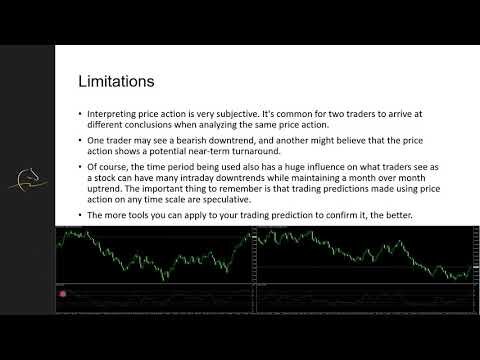

Crypto ETFs either own the cryptocurrency futures, options or other crypto-based securities, in contrast to traditional ETFs that directly own the underlying asset. The intention is to emulate the fundamental cryptocurrency’s price fluctuations. However, there may be periods when the ETF movements don’t precisely match those of the underlying eur usd forecast 2021, 2022 cryptocurrency because they don’t hold any of it themselves. A cryptocurrency exchange-traded fund tracks the price of one or multiple digital tokens and consists of numerous cryptocurrencies. A bitcoin exchange-traded fund allows investors to gain exposure to the biggest cryptocurrency by market cap without actually owning any.

GBTC approval could return a ‘couple billion dollars’ to investors: Grayscale CEO – Cointelegraph

GBTC approval could return a ‘couple billion dollars’ to investors: Grayscale CEO.

Posted: Sun, 26 Feb 2023 08:00:00 GMT [source]

In their current form—and the form desired by many investors—Bitcoin ETFs are designed to allow more people to invest in Bitcoin without the necessary expenses and hassles of buying them. They eliminate the need for security procedures and excessive funds while providing a familiar investment type. Full BioNathan Reiff has been writing expert articles and news about financial topics such as investing and trading, cryptocurrency, ETFs, and alternative investments on Investopedia since 2016. ETFs usually charge management fees for the convenience they provide. Therefore, owning a significant amount of shares in a Bitcoin ETF could lead to high management fees over time.

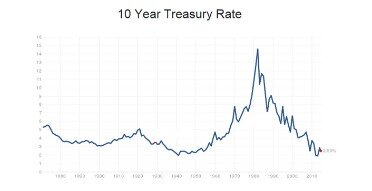

With a market capitalization of $425.66 billion in mid-September 2022, bitcoin appears to be firmly entrenched in our economy despite dropping from a high of $1.3 trillion reached in November 2021. Most ETFs are designed to be very low in cost and passively managed, tracking well-known indexes such as the Standard & Poor’s 500 index (S&P 500) or the Bloomberg U.S. Aggregate Bond Index. However, as the popularity of ETFs continues to grow, the vehicles are being structured in newer, more exotic ways — often using leverage- or options-based investing strategies.

Bitcoin Futures ETF

Cold wallets, a type of crypto wallet, are digital cryptocurrency storage on a platform not connected to the internet, which protects them from hackers. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst. For example, BITO is listed on the New York Stock Exchange , BTF trades on Nasdaq, and XBTF trades https://day-trading.info/ on Cboe Global Markets. Read on to learn what Bitcoin futures ETFs are, how they work, and if they are the right choice for you. Get in-depth knowledge on the European ETF market by subscribing to all our newsletters that deliver expert analysis, market insights and industry events. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period.

Statement Regarding the Commission’s Disapproval of a Proposed … – SEC.gov

Statement Regarding the Commission’s Disapproval of a Proposed ….

Posted: Fri, 10 Mar 2023 18:30:07 GMT [source]

Securities and Exchange Commission has proven challenging, with over a dozen applications and proposals rejected over the past few years. For the longest time it appeared as if nothing would change for the better, although things look a bit different in 2022. An insurance industry ETF invests primarily in insurance companies to obtain investment results that closely track an underlying index of insurers.

ETF (exchange-traded fund)

PIPEDA offers clients the right to access their information upon request and challenge the information that is being retained. The content on this Website is provided for informational purposes only and is not intended to provide financial, legal, accounting or tax advice and should not be relied upon in that regard. The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in.

In these roles, Andy has seen cryptocurrency develop from an experimental dark-web technology into an accepted part of the global financial system. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

Bitcoin ETFs

Some ETFs, like Viridi Bitcoin Miners ETF , invest in companies that mine Bitcoin. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page.

What is the best ETF for bitcoin?

The best or top crypto ETF in terms of expense ratio is The VanEck Digital Transformation ETF at 0.5%. VanEck Bitcoin Strategy ETF, Global X Blockchain & Bitcoin Strategy ETF BITS, Siren Nasdaq NextGen Economy ETFs (BLCN), and First Trust Indxx Innovative Transaction & Process ETF LEGR charge only 0.65% each.

Crypto ETFs work exactly like any other traditional asset-backed ETF. You do not have to understand blockchain and cryptocurrencies to take advantage of the crypto market’s volatility. Although, it does help to learn about the markets in which you want to invest. In Australia, most ETFs are “passive” investments – this means they track the value of an underlying asset or index.

Who Should Consider this ETF?

ProShares now offers one of the largest lineups of ETFs, with more than $55 billion in assets. The company is the leader in strategies such as dividend growth, interest rate hedged bond and geared ETF investing. ProShares continues to innovate with products that provide strategic and tactical opportunities for investors to manage risk and enhance returns.

- In the cryptocurrency market, a fund that tracks the price of one or the multiple digital tokens and consists of various cryptocurrencies is called a cryptocurrency ETF.

- However, despite the growing popularity of bitcoin ETFs, they are still a relatively new investment product and not yet widely adopted.

- The ETF holds the underlying assets, typically in the form of cryptocurrencies, and issues shares that can be bought and sold on a stock exchange.

- Read on to learn what Bitcoin futures ETFs are, how they work, and if they are the right choice for you.

- For example, the price of a Gold ETF would track the value of the gold reserves that are represented within the ETF.

However, unlike with traditional stocks, ETFs charge an annual expense ratio, which will be deducted from the investor’s account. Futures are an agreement between two parties to sell a particular asset at a future date. They allow traders to speculate about how prices may move in the future with minimal upfront investment because they frequently use leverage, or borrowed money. One advantage of XBTF is that it’s structured as a C-corp, unlike many other ETFs that are registered investment corporations.

Considering the SEC just approved Bitcoin futures ETFs for the first time, more funds are hopping on the opportunity to take advantage of the Bitcoin Futures ETF market in the US. Meanwhile, BITO has made history by becoming the fastest ETF to reach $1b in assets. But the correlation between bitcoin and futures remains tight, despite investor concerns last year that there would be too much variation between the spot market and the futures market. Cryptocurrency Exchange Traded Fund allows equities traders to speculate on the cryptocurrency markets and execute trades from their primary brokerage accounts.

Are bitcoin ETFs worth it?

If you don't want to actively manage your crypto investment, but you want a way to diversify your portfolio with a high-risk, high-reward asset, a Bitcoin ETF is a better option than directly buying Bitcoin.

A cryptocurrency mutual fund specializes in investing in one or more digital currencies. Apart from the regulation, one should be aware of the risks of cryptocurrency exchange-traded fund investments. For instance, beginners or advanced traders need to understand that there is a limited choice of funds to start exploring cryptocurrency ETFs. Also, the available funds track only a few digital currencies and are subject to cybercrime risks like hacking. Along with offering indirect exposure to BTC, Bitcoin ETFs could pose risks to investors if the fund holds a sizable portion of the futures market.

Performance information may have changed since the time of publication. A Bitcoin ETF is an exchange-traded fund created to track the price of Bitcoin. Shares of a BTC fund are listed on traditional exchanges allowing regular traders to buy and sell them through their brokerage accounts. Brazil got its first Bitcoin ETF in June 2021, launched by Rio asset manager QR Asset Management.

A Bitcoin ETF is an exchange-traded fund comprised of bitcoin or assets related to Bitcoin’s price. They are traded on a traditional exchange instead of a cryptocurrency exchange. Theoretically, bitcoin is purchased by the company, securitized, and sold or traded on an exchange.

Is bitcoin ETF risky?

Along with offering indirect exposure to BTC, Bitcoin ETFs could pose risks to investors if the fund holds a sizable portion of the futures market. Therefore, investors should be cautious while investing in volatile securities like cryptocurrencies.

Under PIPEDA no business may collect, use or disclose personal client information without clearly defining the purpose of such collection, use or disclosure and obtaining informed consent. The collection, use or disclosure is limited to purposes that a reasonable person would consider appropriate in the circumstances. The legislation further regulates the protection, retention and destruction of client information.

Keep in mind that some funds have limited spots, so even if you meet the requirements you may not be able to purchase the ETF right away. Just because you don’t have to deal with any of the risks of owning digital currency, that doesn’t mean these risks cease to exist. Issues such as hacking will still need to be managed by the ETF provider.

BITO provides a familiar way to gain exposure to bitcoin-linked returns with the liquidity and transparency of an ETF. You may purchase or trade Evolve ETFs directly through your online brokerage account. There are two types of Bitcoin ETFs — physically-backed and futures-backed. Although the underlying asset — in this case, BTC — might be the same, these two instruments are functionally quite different. Always conduct your own diligence, and remember that your decision to trade or invest should depend on your risk tolerance, expertise in the market, portfolio size and goals.

Availability is also limited depending on what markets you have access to. For instance, in Canada retail customers can purchase physical ETFs, but in the US they are regulated to accredited investors. While the vast majority of cryptocurrency exchanges hold funds on your behalf, some users are still nervous about the storage of cryptocurrencies. This may be due to the long history of exchange hacks, or a misunderstanding that they need to manage the coins themselves.

What is the difference between bitcoin and bitcoin ETF?

For regulatory reasons, Bitcoin ETFs don't invest directly in Bitcoin. Rather, they are based on financial products, such as Bitcoin futures contracts, or other investments that correlate to the price of the cryptocurrency. (Similar vehicles exist for other coins.)