Contents:

Chatham Hedging Advisors, LLC is a subsidiary of Chatham https://1investing.in/ Corp. and provides hedge advisory, accounting and execution services related to swap transactions in the United States. For further information, please visit chathamfinancial.com/legal-notices. This model is the one brokers use to factor in the portion of the property financed by debt.

Apply online for expert recommendations with real interest rates and payments. The Structured Query Language comprises several different data types that allow it to store different types of information… Current market value of the asset is the value of an asset on the marketplace.

Generally, floating-rate bond products are not affected by standard market pricing mechanisms when rates rise because their interest rate levels are not fixed. However, if a bond has an interest rate cap, then the cap could adversely affect the secondary market price when the cap is reached, decreasing the trading value. Adjustable-rate mortgages typically have a rate cap to limit how much interest homebuyers pay for a home loan. The relationship between interest rates and cap rates is complex.

But Joe Evangelista and Dave Tesch also knew the old adage “cap rates explained, location, location,” and saw this office building had lots… The property—3.44 acres of vacant land—was on a busy corner in Westland, ideally located for a gas station or car wash. Sometimes we hear that every property listing has its Perfect Buyer. Thomas Duke Company agent Jon Norton was asked to list the commercial building at 6952 John R Road in Troy.

What Is Capitalization Rate?

It also has high demand from a constant influx of real estate renters and buyers . The latest real estate investing content delivered straight to your inbox. This common metric can help investors assess the potential value of a property. Get the strategic support to be successful throughout market and real estate cycles with insights, hands-on service, comprehensive financial solutions and unrivaled certainty of execution. Residual income is money that continues to flow after an investment of time and resources has been completed. In another version, the figure is computed based on the original capital cost or the acquisition cost of a property.

Visa aims to lower credit surcharge – Payments Dive

Visa aims to lower credit surcharge.

Posted: Thu, 02 Mar 2023 16:45:35 GMT [source]

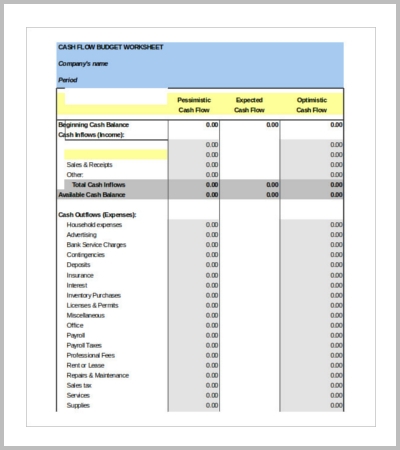

Net Operating is a calculation of the income generated by an actual estate investment. Investors use NOI to determine the worth and profitability of an earnings-producing property. In terms of cap charges, this implies San Francisco haslowcap charges (i.e. excessive prices). Is the capitalization rate used to define the value of the property when the investor acquires some real estate.

How the interest rate cap is determined

This material has been prepared by a sales or trading employee or agent of Chatham Hedging Advisors and could be deemed a solicitation for entering into a derivatives transaction. This material is not a research report prepared by Chatham Hedging Advisors. There are a lot of risk factors to evaluate and consider. But, as a buyer of a property, you would want a higher cap rate. This is because a higher cap rate would mean a lower initial investment. It can give a sort of indication of the trend of real estate prices.

The head wind of the current economy is truly a force to be reckoned with. At the Thomas A. Duke Company we know how to harness that head… Customer-Driven Property Management – Everything we do Maximizes your investment. Old Woodward has been home to Azar’s Oriental Rugs, a highly successful local business. After 30 years of serving Birmingham, the owners were ready to retire and close…

You also learned how to apply it to your personal investment purchases. After all, the income from these properties is what we aspiring early retirees use to build wealth and reach financial independence. By accepting cap rates so low that you produce no income today, your growth depends 100% on outside forces. Property #1 is a 10-unit building available for a price of $1,000,000. It’s fully rented, needs no major repairs, and has a good management company in place. The location also has good long-term prospects for population and economic growth.

The cap price doesn’t, nevertheless, embody funding property financing as a part of the funding property expenses subtracted from the rental income to get the NOI. This means finding out the actual property market, performing real property market analysis and finally investment property analysis. All of these items are rather more essential to the big picture of successful actual property investing. To calculate the cap rate for an funding property, take the property’s net operating revenue and divide it by the property’s market worth. For a property you may purchase, use the anticipated buy worth in place of the market worth.

Suppose you have $10,000,000 to invest, and 10-year treasury bonds are yielding 3% annually. This means you could invest all $10,000,000 into treasuries, considered a very safe investment, and spend your days at the beach collecting checks. What if you were presented with an opportunity to sell your treasuries and instead invest in a Class A office building with multiple tenants? A quick way to evaluate this potential investment property relative to your safe treasury investment is to compare the cap rate to the yield on the treasury bonds. You might also be trying to find a market-based cap rate using recent sales of comparable properties.

He built to a 7 cap however the market is a 5 cap and therefore the value is 28 million. Buyers can construct zero cost reverse collars when it is possible to find floor and cap rates with the same premiums that provide an acceptable band. With 30 years of experience and a history of successful sales of student rental properties, we sometimes think we know all the possible obstacles to closing on these deals.

Interest rate cap terms will be outlined in a lending contract or investment prospectus. Common types of capped interest rate products include adjustable-rate mortgages and floating-rate bonds. It illustrates class C properties versus class B properties. The cash flow looks great but the tenants suck and so you end up with more risk and a higher cap rate that never materializes in real life. I find a lot of people play with the assumptions of vacancy / repairs. I also see to often they don’t evaluate based on some of the other factors you mention.

Other Methods of Valuing Property & Returns

This is because the formula itself puts net operating income in relation to the initial purchase price. Investors hoping for deals with a lower purchase price may, therefore, want a high cap rate. Following this logic, a cap rate between four and ten percent may be considered a “good” investment. According to Rasti Nikolic, a financial consultant at Loan Advisor, “in general though, 5% to 10% rate is considered good.

Investors should not use the capitalization rate if they need to create stabilized projections of the Net Operating Income. Using cap rates would produce a valuation amount that may be nearly equal to an amount that is derived using the complex discounted cash flow analysis. The Capitalization Rate may consider various factors, but it does not reflect the future risk. It assumes a sustainable income from the real estate property, but no guarantee could be made to such an assumption.

The volatility is known as the “Black vol” or implied vol. The objective of the buyer of a collar is to protect against rising interest rates . An interest rate floor is a series of European put options or floorlets on a specified reference rate, usually LIBOR.

Cap Rate Vs ROI

Inverse relationship to value, so if the property’s operating costs change in the future years, the cap rate changes and therefore its value. Capitalization approach is the same concept used to calculate what an investment in a rental property should be. Income from office property through REITREIT is an entity that owns income producing real estate assets.

- Let us return to our example, assuming that the capitalization rate for the commercial building is correct.

- Keep in mind that NOI should be used in addition to other analysis tools, corresponding to cap fee, ROI, comparable properties rental income, and cash move.

- But even in that case, had I known the real risks up front, I would have required a higher ROI.

- This provides sufficient time for Chatham to thoroughly review the cap terms and to identify and onboard with the most price competitive and creditworthy cap providers.

- Therefore, other metrics should be used in conjunction with the capitalization rate to gauge the attractiveness of a real estate opportunity.

So, investors here demand higher cap rates to compensate for this risk. The formula can be used on the level of an individual property by looking at its net operating income compared to its value. But it can also be used on the level of an entire market by takingaveragecap rates for a large group of properties. I’ll also share examples of how to use the cap rate formula in a very practical way to analyze real estate markets and rental properties. The next step is to divide the net operating income by the current market value. Although there is some debate among investors on whether the current market value or purchase price should be used, the majority of investors work with the current market value of the property.

Mutual fund Investments

Within the context of real estate valuation, the most important interest rate is the one paid on the 10-year US Treasury, sometimes called the risk-free rate. Instead of working through hours of long equations and phone calls with sellers, investors can simply look up a property’s value, NOI, and cap rate on Reonomy. They are calculated by contrasting criteria from recently sold properties including geography, sales price, age of building, size and square footage.

Your local real estate agent uses the normal sources to look for properties, including the MLS , Loopnet.com, and networking. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company. She holds a bachelor’s degree in journalism with an emphasis in political science from Michigan State University, and a master’s degree in public administration from the University of Michigan.

- Investment opportunities offered by RealtyMogul are speculative and involve substantial risk.

- For more than two years, the owner of a 20-unit motel with an attached restaurant struggled to sell the property on his own.

- Usually, companies acquire an existing business to share its customer base, operations and market presence.

- Since cap rates are based on the projected estimates of the future income, they are subject to high variance.

The property, which would then have a lower cap rate, could be held or sold for a profit. Remember, as an investor, you have a lot of control over the performance of a given property. With the right planning and execution, you can change the cap rate and boost your portfolio in the process. It is worth pointing out that calculating a property’s market cap is contingent on gathering accurate information. Therefore, you will need to mind due diligence and make certain that you can pinpoint the net operating income. To do so, estimate the rental property’s annual revenue and then subtract the total operating expenses.